Tech Take-privates – A Rising Trend?

Run-down – Take-privates

A take-private transaction involves taking a publicly held company private through an acquisition or leveraged buyout (LBO). Companies are taken private to achieve a financial or strategic objective that is otherwise less achievable when publicly listed, such as enabling management to prioritize long-term objectives or for the buyer to realize tax-benefits from a more leveraged capital structure. A large advantage to take-privates is fewer regulatory and reporting requirements, creating more flexibility to allocate organizational efforts more productively.[1] Take-privates are commonly undertaken by investors to enhance a company’s value and correspondingly increase its valuation. This can be executed through improving operations and leveraging new technology.[2]

Incentive for Take-privates

The slide in public markets has created difficult conditions for Private Equity-backed companies to exit into the public market. Additionally, the high interest rate environment has made debt financing unfeasible. These factors provided an incentive for Private Equity (PE) firms to participate in take-privates. The benefit that PE firms will derive from taking companies private in the current market is the opportunity to earn an attractive profit from the foreseeable discount-to-premium spread. The spread will be captured when PE firms exit their investments at a premium, during favorable market conditions.[3]

Total Capital Invested

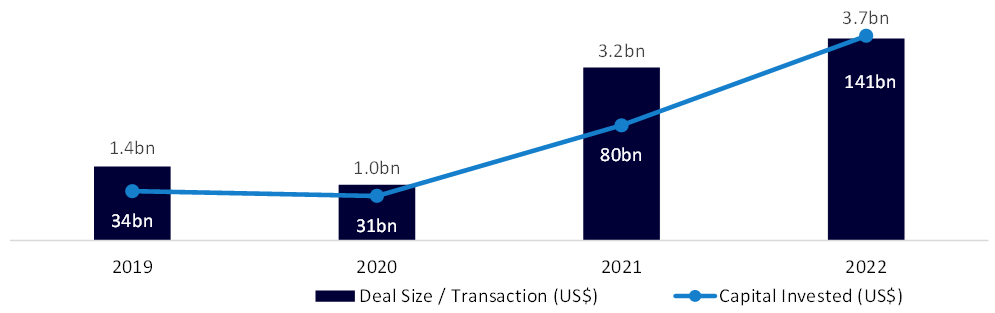

Take-private capital invested has ramped up significantly from 2019-2022, growing at a CAGR of 28.5% in line with deal count. The deal size per transaction has continued to climb, indicating that more capital is being shoveled into each take-private transaction, which is likely the cause of climbing take-private valuations.

Take Private Deal Count

In 2022, there are a rising number of take-privates, motivated by depressed financial markets across the U.S, Canada, and Europe. Accordingly, companies have likely repositioned their efforts to pursue long-term growth strategies in place of short-term profitability. Reduced valuations for publicly traded companies have prompted PE firms to step in. Take-private transactions have expanded in both number and size and could maintain this momentum if current market conditions persist.[4]

Take-privates and IPOs – Valuation Multiple

IPO valuations are determined through in-depth due-diligence and financial analysis, but are also influenced by market trends, and the prevailing market price of firms in similar or adjacent industries.[5] Over the past four years, IPO valuations have closely mirrored those of take-private valuations which could indicate that take-private valuations are creating a floor for valuations in the public markets.

Take-private Highlights – 2022

Take-private deal sizes in 2022 have dwarfed prior years, with three of the largest deals amassing a total US$45.5bn deal value. The largest transactions included Citrix Systems, CyrusOne, and McAfee, covering both the Software and IT Services industries. Overall, US$141.8bn has flowed into take-privates in 2022.[6]

Recap

Take-privates have become more popular due to the instability of the equity markets. This is because many public companies are trading at a discount due to shrivelling market caps, this has motivated PE firms to exploit the opportunity. Notwithstanding, the number of take-privates will likely return to natural levels upon market recovery.

Written by Michael Gagnon.

Photo by Connor Danylenko.

[1] Investopedia: Why Public Companies Go Private

[2] S&P Global: Private equity firms spend big on take-private deals

[3] Pitchbook: 2022 US Private Equity Outlook

[4] Pitchbook

[5] Waymark Capital: Pre IPO-Insights

[6] Pitchbook