Deconstructing the Series A Software Market

Series A financing is a stage of the capital raising process for start-ups and rapidly growing companies. This form of financing is equity based, meaning that companies exchange their equity for capital. At the Series A stage, the equity issued is typically preferred. The primary objective of this financing is to propel company growth through means of product development, talent acquisition, and market expansion. The amount of capital raised in a round is contingent on due diligence and valuation, that is generally performed by investors or “VCs” involved in the process. [1]

Climbing Deal Size

Over the period of 2013 – 2022, Series A deal sizes have maintained an attractive uptrend that runs contrary to the existing deal count. Deal sizes have been uplifted by valuations and investor participation. Valuations have been determined by anticipated growth rather than fundamentals, which has supported the expansive capital deployment in Series A deals. The increase in participation from investors has also put upward pressure on valuations. In part, larger multi-stage investors have been increasingly aggressive in their level of activity, which has boosted early-stage participation. Larger Series A deal sizes have also benefitted from being less correlated to public market indices, which has been conducive to stronger investor pools.[2]

Deal Size and Employee Count

Despite the median employee count generally increasing since 2013, the deal size relative to employee count has increased dramatically. The growth in deal size independent of employee count further indicates that the primary cause of the growth can be attributed to heightening valuations. So far, 2022 has experienced a notable deal size/employee that has been supported by a decline in the median number of employees.

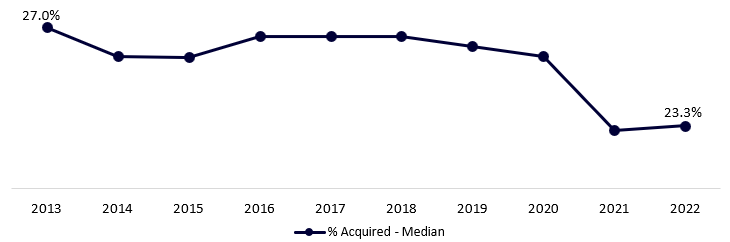

% Acquired and Valuations

The decrease in the number of Series A buyouts combined with the record number of VC dollars raised in 2021 implies a larger number of minority investors participating in the Series A capital raising process. Investors rely on other VCs to invest at a higher valuation, meaning that larger investor pools nod to stronger valuations. [3] Consequently, the downtrend in the % acquired for Series A deals points to valuations being a core driver for increasing deal sizes.

Recap

The recent decline in the number of Series A deals outlines the likelihood of a bubble existing, as the downward movement has been especially pronounced over the last twelve months. Moreover, deal sizes have inflated significantly over the past decade, which could be another indication of a bubble in the Series A market. If there is indeed a bubble, the necessary question to ask is “When will it pop?”, if it hasn’t already.

Written by Michael Gagnon.

[1] Corporate Finance Institute: Series A Financing

[2] PitchBook-NVCA: Venture Monitor Q3 2022 Report

[3] PitchBook-NVCA: Venture Monitor Q3 2022 Report