Public Software Balloons?

A balloon or a bubble in simple terms is when the price of an asset accelerates and far exceeds the asset’s intrinsic value with no rationale. Speculation is the root cause of balloons and does not consider the underlying fundamentals of companies. Traders and investors irrationally increase the price of the asset in fear of missing out on profits or participate in a herd mentality to continue to buy the asset at a higher price. Eventually, the balloon or bubble becomes too big and pops, leaving people panicking and many holding the proverbial hot potato. There are many reasons why balloons pop that range from technological advancement, missing earnings, changing economic factors, and even fraud. With that being said, it is often not clear when there are large balloons present and even the most sophisticated of investors often get burned when these assets burst.

Did Covid-19 Help Create Software Balloons?

When Covid-19 was in its early stages many concerns over long-term closures, supply chain disruptions, non-remote business models, and many other factors caused stocks to fall and investors to panic. However, throughout the pandemic, there are many “pandemic-proof” business models taking flight to all-time highs. Software companies, in particular, were positively affected as Work from Home, EdTech, E-commerce, AdTech, and Cybersecurity all experienced an increasing need when remote working and learning became a necessary reality.

In the short-term this makes sense, if remote learning and working really is the future then shouldn’t these companies experience fundamental financial and metric improvements as more and more users shift to their platforms? Metric or financial performance improvement would be a rational source of an asset’s price rising and therefore not a real balloon. However, it is important to understand that a certain amount of increased performance can account for a certain amount of price increase and that balloons can still be inflated when the prices of assets soar well above the reported fundamental improvement.

The metrics that will be discussed in this article will be Revenue Growth, User Growth, and Management’s Forward Projection of Revenue Growth. These metrics are reported by all public companies and can be useful proxies in determining why investors and traders are optimistic or pessimistic about future stock performance.

Stock Performance

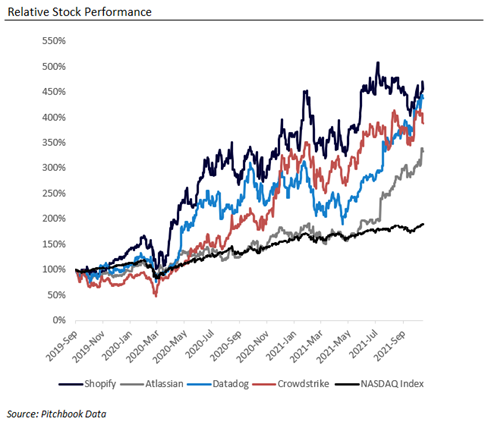

The companies that will be analyzed will be Shopify (an E-commerce platform for small and medium-sized businesses), Datadog (a monitoring and analytics platform), Crowdstrike (a cyber security vendor), and Atlassian (a project planning and management software provider). These selected companies are good examples of how hard it is to tell if there are publicly traded software balloons caused by Covid-19.

As depicted above, all four of these stocks experienced a rapid drop around March 2020 when Covid-19 first became a major concern, and the World Health Organization declared an official Global pandemic. However, shortly after the pandemic all four companies rebounded and showcased extremely strong performance even when compared to an index such as the NASDAQ. By taking a closer look at trailing twelve months (TTM) and next twelve months (NTM) Total Enterprise Value (TEV) over Revenue multiples, we can dive further into how these companies were valued throughout the past two years.

Pre-covid-19 we can see that historical and future revenue multiples remained relatively flat or slightly decreased. However, as we enter Q1 2020 something interesting happens. Revenue multiples begin to soar and remain at this level until present day. Before we investigate the actual reported forward guidance from management and real growth metrics one could only assume that these valuations should be justified by optimistic projections and real growth, right?

Key Performance Metrics

When we look at these key performance indicators, growth metrics, and forward projections it is safe to say that they do not trend in the same direction as the valuation multiples. Using Q1 2020 as a turning point for all TEV/Revenue multiples we see that in almost all cases of revenue growth, user growth, and forward growth these metrics remain flat or decrease. So now we must ask ourselves what is driving the value here if anything at all? Is it the future-proof business models that will prove to take over their respective ecosystems in years to come? Is it the herd mentality behind investors not wanting to miss out on returns? Or is it the short-term resiliency of these companies that promise performance should another global pandemic occur? It is hard to say if these companies are truly ballooning or not, but the metrics would suggest that these multiples are unjustified and irrational.

It is important to note that there could be alternative factors behind valuation such as new technology acquisitions or strategic business plans to enter adjacent markets that could have a positive influence on investor sentiment regarding these companies. However, these are highly unlikely factors unless they are sizeable, scalable, and actionable in the near term.

If these four companies truly are balloons, then over time they should burst and return to a more rational valuation multiple much closer to their true intrinsic value. If fundamentals, performance metrics, and forward projections are any indication or signal of stock price performance then these software companies and many more will be in for a roller coaster ride in the near future.

Written by Andre Breton of Sampford Advisors.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, ON, Ottawa, ON, and Austin, TX and have done more Canadian mid-market tech M&A transactions than any other adviser.

Photo by Kyle Hinkson on Unsplash