VC Market Post Covid

It’s been over a full quarter since a state of emergency was declared in the United States (and elsewhere in the world) in light of the COVID-19 pandemic. COVID-19 sent shockwaves through the business community and created a serious sense of uncertainty and volatility in the market, especially in late March / early April.

COVID-19 has had some serious implications on aspects of the fundraising and M&A market, and we at Sampford have witnessed some of these impacts first-hand. We’ve seen and heard of companies who have been severely devastated by the pandemic, but we’ve also seen others who have emerged even stronger in light of some of the new market trends / shifts, such as work from home.

In this blog, we look at the current impacts on the VC fundraising market, with one full quarter of data post the state of emergency declaration in the US on March 13th, 2020.

VC Funding Deal Volume

Over the last two calendar years, we’ve seen a general decline in early stage deals, with stability or growth in mid and late stage deals. However, in Q2 2020 we saw an even sharper decline of 45% in early stage deals relative to the year prior (Q2 2019), and the initial signs of weakness in mid stage deals, which declined by 29% during the same period. Late stage deals on the other hand actually grew by 10% over the same period, signaling that investors are placing their bets on more mature and stable companies, and perhaps ones that they already have pre-existing relationships with.

Source: Pitchbook; All US & Canadian Deals

Dollars Invested

In extension to deal volume, we see similar trends in dollars invested. Early stage deals have been declining over the last two calendar years, while mid stage and late stage have been growing in the double digits. Early stage dollars invested continued their fall, posting a decline of 18% in Q2 2020 relative to the year prior. However, mid stage deals showed their first notable drop, posting a decline of 46% in Q2 2020 relative to the year prior. Late stage deals on the other hand continue to be resilient, posting an increase of 17% in Q2 2020 relative to the year prior.

Source: Pitchbook; All US & Canadian Deals

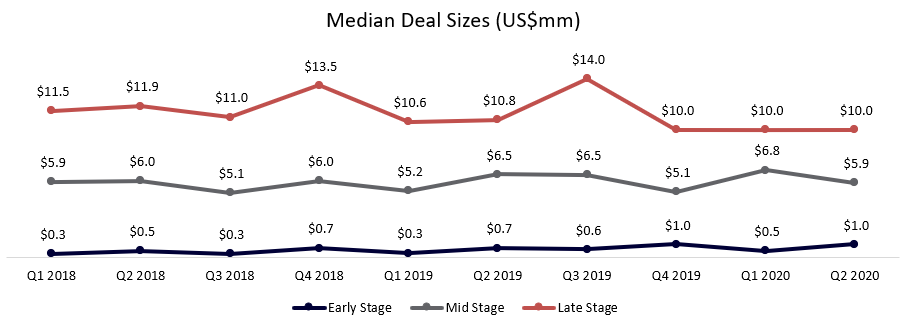

Median Deal Size

As it relates to actual deal sizes, we’ve seen a considerable uptick in the median deal sizes of early stage deals. This signals that investors are being much more selective with their investments (remains consistent with the sharp decline in deal volume), but may also signal that VCs are focusing on companies they have invested in in the past and are doing larger additional rounds of funding. Late stage deals on the other hand have shown a small decline in the median deal size, signaling that early or mid-stage investors may be moving upstream looking for “safety” or that late stage investors aren’t comfortable contributing larger amounts of capital like they once were.

Source: Pitchbook; All US & Canadian Deals

So What Does This All Mean?

The early stage funding market is contracting and deployment is slowing as VCs focus their efforts on companies that (1) are doing well in this environment, (2) are well known, or (3) that they already have a pre-existing relationship with / have invested in the past. It would be reasonable to expect some level of stability in the late stage funding market, but more volatility or a decline in the early and mid stage funding market.

COVID-19 has definitely re-shaped the landscape for doing due diligence on potential investments, and VCs are still adjusting to doing due diligence 100% remotely and without meeting a potential investment opportunity in-person – this makes it much harder for startups looking for their first round of funding with no pre-existing VC relationships. It will take some time for VCs to adjust to this new way of doing due diligence, and in the meantime, we can expect them to continue to be very selective with their investments.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, ON, Ottawa, ON, and Austin, TX and have done more Canadian mid-market tech M&A transactions than any other adviser.