“Techquisitions” - A Growing Trend

Introduction

In today’s digital era, consumer expectations are at their highest – they’re constantly demanding a product or solution with improved features and functionality, or a service that’s delivered through a better channel (e.g. digital), among other things. Additionally, businesses are recognizing the need to automate in order to stay ahead of their competition, as well as find creative ways to grow revenues and drive profitability. With all that said, many businesses today have turned to adopting technology to meet these ever growing needs.

Some companies have been quite successful at adopting technology, like Amazon, who has completely reshaped the retailing industry like never before. With Amazon, we now have our first ever one-stop online store where we can find / buy virtually anything we need, make orders with one-click or through voice commands, and have those products delivered to our doorstep within 1-2 days. Much of Amazon’s success has been due to their continued investments in innovative technologies and related practices, as well as constantly striving to automate. An example, among many others, was the launching of Amazon Marketplace in 2000 which gave merchants the option to pay to list their products on Amazon’s “digital shelves” which in-turn allowed Amazon to dramatically increase their own product selection without having to buy the physical inventory.

Although there’s been many successes in adopting technology, there’s also been many failures. Take Blockbuster, for example, who was once the leading video rental company. While they survived much of the change from VHS to DVD, they failed to develop a digital delivery method that consumers were demanding. Netflix, on the other hand, went from delivering DVDs to your doorstep to developing an online platform that allowed consumers to watch a movie or TV show instantly with the click of a button, right from their couch. Blockbuster always saw themselves as the “leading” movie rental company and because of that, they felt no need to change. The sad part, however, is that back in 2000, Netflix proposed a partnership with Blockbuster, where Blockbuster would advertise Netflix in-store, and Netflix would manage Blockbuster online. Blockbuster turned down the offer and later filed for bankruptcy in 2010. Today, Netflix is worth over $150 billion.

It’s no surprise that growth is in technology and technology adoption. We can see that by looking at the S&P 500’s technology sector index, which delivered a compound annual growth rate (CAGR) of 18.0% over the last 10 years, while the non-technology sector index only returned 10.7%. Not only that, but the market sees technology companies as significantly more valuable on a relative basis. The weighted average valuation of the constituents of the S&P 500’s technology sector index was 5.7x revenue, while the non-technology sector index was 2.3x. However, greater returns often come with greater risks, and technology companies are plagued with failures just as they are with successes.

Today, most companies recognize the need to adopt technology. However, many of those in traditional non-technical industries don’t have the domain expertise to do this. Accordingly, M&A is increasingly being used as a strategic tool to drive faster and more effective adoption of technology, and we’re seeing it being used across almost every non-technical industry. In the below, we detail a few examples of how some house-hold names in different non-technical industries are acquiring technology companies (or making “techquisitions”) in order to drive process efficiencies, serve their customers better, scale revenue in a much more effective way, and ultimately stay ahead of their competition.

Retail

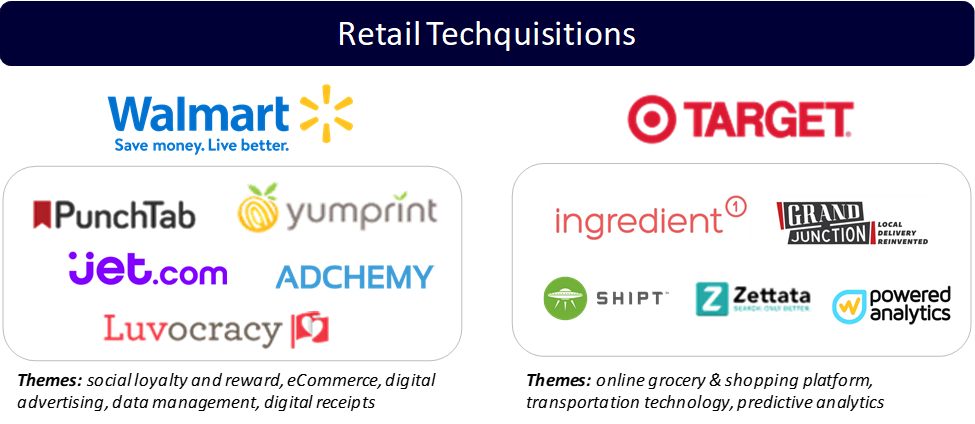

For a long time, companies in retail steered clear from acquiring “risky” technology companies. However, with the entrance of Amazon and the way that they’ve revolutionized the industry, many now understand that adopting technology will be the only way to survive or maintain their current market position. Many have already started to make this move, like Walmart.

Walmart’s journey largely started in 2011 when it acquired social media technology platform Kosmix and later rebranded it to WalmartLabs, an entity that would serve as Walmart’s “technology brains”. This later led to a series of acquisitions, such as Yumprint (digital receipt technology for grocery delivery) in 2014, Luvocracy (product recommendations), and PunchTab (customer engagement) in 2015, among many others. Target, like Walmart, is another house-hold name who has followed this technology driven trend.

Consulting

Consulting organizations have long been project based and service oriented organizations. However, more recently, we’ve start to see many push to become more “product oriented”. The traditional service-based model will never disappear, far from that, but there are underlying scalability issues with the traditional service based model that can be addressed by introducing a technology product as an offering.

This is a trend we see happening in the broader consulting industry, and giants like KPMG and Accenture are being increasingly aggressive with their technology acquisitions. Often times, these large consulting giants have strong reach and capabilities to address a specific need in a particular market, such as audit and tax. However, a larger portion of the market can be addressed, or customers could be better served, with the introduction of a technology offering or a technology enabled service. Take KPMG, for example, who acquired G2 FinTech, a tax technology firm. G2 FinTech specialized in tax analysis and compliance software and allowed KPMG to better serve their hedge fund clients with their tax compliance needs.

Financial Services

Banks and other financial services institutions have long been aggressive acquirers of technology companies, and perhaps it’s because it’s an industry that’s extremely focused on its bottom line! However, the financial services industry is also one that’s concentrated but still hyper competitive, and banks and other financial institutions are constantly trying to find creative ways to distinguish themselves from their competition (seriously, when you compare Scotiabank and TD, what’s the difference?). A common way these institutions distinguish themselves from their competition is by expanding their offering, or by speeding up the delivery of an enhanced feature set, among others – a great example of this was CapitalOne’s acquisition of San Francisco-based digital identity and fraud alert startup Confyrm in 2018, which allowed them to speed up the development and delivery of a proprietary consumer identity solution.

Conclusions

Technology adoption will continue to play an important role for companies who want to effectively distinguish themselves and compete in the digital era. The above examples are not by any means exhaustive and only touch the tip of the iceberg. Technology adoption is much, much broader and we at Sampford expect to continue to see more emphasis placed on it.

Written by Boris Petkovic of Sampford Advisors.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, Ottawa and the US and have done more mid-market tech M&A transactions than any other adviser