Downcycles and M&A - What to Expect!

With the holidays behind us and another year on the horizon, it feels commonplace to polish up the crystal ball and look towards predictions for the upcoming year. After all, there are many factors at play that could

impact the broader economy and the M&A environment. Given the length of the current cycle, many would say the current macroeconomic tailwinds are set to change and that a downcycle is near. However, rather than offer our own (we’ll leave that in the capable hands of the economists and forecasters), we thought it would be informative to have a quick look at Canadian and US TMT M&A over the past 18 years to see how activity peaks and wanes across business cycles.

Strategic TMT M&A

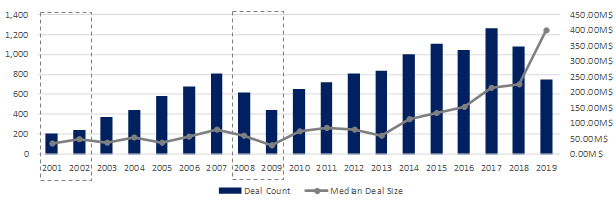

Looking back to the dot-com crash in the early 2000s, there was a decline in M&A volume, but also median deal size – volumes were down 18% in 2002 over 2001 reflecting a paring back of investment, but perhaps not to the extent that would have been expected. Granted, this is across the entire Technology Media and Telecom space.

Corporate / Strategic TMT M&A

Source: Pitchbook.

Prior to the 2008 recession, we saw a run up in the number of deals in 2007, while the median deal value fell 50% over the prior year. Likely a result of a number of factors, valuation likely being one with the increased supply. 2009 saw the lowest median deal value over our population, but as can be seen, the TMT M&A markets were still active (and still more so than the preceding 6 years) as strategic buyers sought opportunities to pick up discounted assets.

Interestingly, we’re seeing a reversal of the historical trends with the volume of M&A decreasing over the last few years, but at a much higher median deal value. Why? Well, 2019 was the year of the mega deal with a number of multibillion dollar deals surpassing historical norms.

PE Buyout TMT M&A

To round this out let see what the data shows for private equity buyout transactions over the same period:

PE Buyout TMT M&A

Source: Pitchbook.

Not surprisingly, on balance the pattern is similar where in 2009 there’s a material decline in both the number of deals and the median deal value. However, the magnitude of decline is more significant for PE buyouts with the number of deals falling 45% 2009 vs. 2007 compared to 18% for strategic purchasers. Private equity buyers are more likely to wait out periods of strong macroeconomic headwinds and are of course more impacted by credit markets and the lending environment.

Looking ahead to today, the same trend of fewer, but larger deals is in vogue. In both cases, 2019 saw the number of deals across the period return to historical averages suggesting a more disciplined overall approach to executing deals.

Capital Deployed

While the above data reveals some trends around M&A activity across business cycles, looking at the amount of M&A capital deployed is far more telling:

TMT M&A Capital Deployed

Source: Pitchbook.

Here we see what this all really means in terms of spending and the overall appetite for pursuing M&A. Not surprisingly the data show a marked decline post downcycle with a slight lag of about a year before investment bottoms out.

What we find really interesting though isn’t so much what happened post 2001 and 2008, but what’s been happening over the last few years. Absolute dollars deployed are up significantly - ~$3.9Tn was deployed 2016 to 2019 which is just about the same as the ~$3.9Tn deployed over the entire period of 2003 to 2015! Clearly M&A has been hot.

Ok so now what? What does it mean if you’re thinking of pursuing an M&A strategy in 2020?

While we’re not sure what’s ultimately going to happen to the economy over the next few years, there are some factors that will likely play an important role in how folks think about M&A in the near and medium term. For one, private equity shops are sitting on record levels of dry powder and strategic buyers are shoring up their balance sheets allowing for disciplined buying opportunities in a downturn. Yes, valuations will fall if we do enter the inevitable downcycle, but buyers will still need to deploy capital (particularly private equity capital) so we expect M&A volumes will in fact still trend higher than the pre 2014 averages. Not everyone will flourish of course, but diligent buyers can expect to see favourable returns in a down market given the availability of cheaper assets. And the low interest rate environment will continue to fuel acquisitions for as long as credit markets are willing to lend.

We expect strategic acquirers will be on the lookout for ways to become more tech enabled and to ensure they’re able to compete in an increasingly recurring revenue and SaaS-focused marketplace. Public acquirers will have to determine if investor sentiment for M&A is positive and will need to be mindful of market timing while shrewd private acquirers will be afforded the freedom to pursue a multitude of corporate strategies, including divestiture of non core assets and acquisitions of core assets to increase scale, consolidate and shore up their competitive advantages so long as they’re not in an overly cyclical industry themselves.

What is clear is that nobody can say with any certainty what will happen, but careful planning is always prudent and certainly even more so in a recessionary environment. The ability to create value will favour those who are disciplined and have a well developed strategy, but as we’ve seen, deals will continue to get done notwithstanding macro economic uncertainty.

So if you’re thinking about taking your business to market this year or within the next few years and we do see the cycles change, consider that the availability of buyers looking for good assets won’t change, but the level of scrutiny will likely increase and valuations will likely fall somewhat as owners scramble to sell under performing assets.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, Ottawa and the US and have done more mid-market tech M&A transactions than any other adviser