Software Update - M&A Trends (November 2019)

November was another strong month for M&A with $9.9bn announced. In terms of notable transactions, StubHub’s sale to Viagogo accounted for nearly half the total, coming in at $4.1bn. OpenText also made a large acquisition, with its deal to acquire Carbonite for $1.4bn, or 3.5x revenue.

Source: Pitchbook.

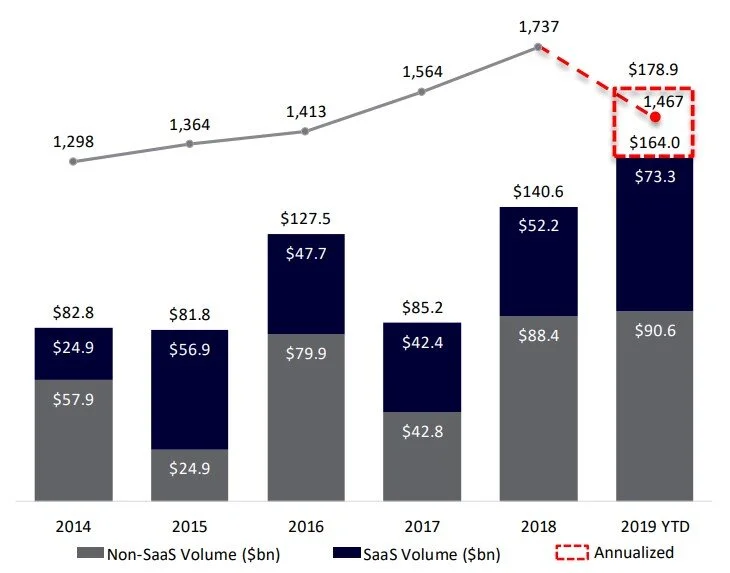

So 2019 is already the best year for Software M&A in recent history with $164bn of transactions being announced or completed. With a few more announcements expected before the end of the year we should exceed $175bn for 2019, which would be nearly 25% YoY growth.

Source: Pitchbook.

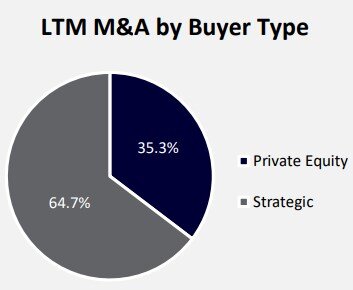

Private Equity continues to be a growing and important buyer in the software space with 35% of transactions in the last twelve months being completed by PE firms.

Source: Pitchbook.

The separation between SaaS and non-SaaS valuations continues to broaden, although as we have indicated before, multiples on true recurring revenue (i.e. the M&S revenues of a perpetual license business) are actually pretty close.

Source: Pitchbook.

The trend of declining number of deals continues as is evidenced by the chart below. This trend is a little worrying to us as its the smaller deals that are getting hit by lighter deal volumes as the large deals have continued to get done. There’s been a real step down in the 6-month average over the last 2 years and this is a trend we will continue to monitor to see if it gets materially worse.

Source: Pitchbook.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom (TMT) companies. We have offices in Toronto, Ottawa and the US and have done more mid-market tech M&A transactions than any other adviser.