Canadian VC investments dramatically lag US....why?

While it's been encouraging to see some of the big Venture Capital (VC) investments into Canadian technology companies over the last few months, the headlines cover-up a much more alarming trend. If you look at dollar volume of VC investments as a % of the activity in the US, the trend has actually been in the opposite direction - i.e. there is less money being invested today in Canada as a % of the money that's being invested in the United States than there was in 2012. This can be seen more clearly in the chart below which shows that we are currently clocking in at around 3% vs over 5% in 2012.

Source: Pitchbook.

You might argue that Canada is obviously a lot smaller than the US so you would expect us to be a fraction of them in terms of VC investment. However, on most metrics we are 10% their size (GDP, Population, etc), so we should be much close to 10% and not the 3% we have been over the last 4 years.

Let's dig into the data a little deeper to see what conclusions we might be able to draw. If we look at early stage transactions (Seed through A/B) we are coming in at 3.9% of the dollars invested (blue bar below) and 6.1% of the number of transactions (grey bar). So this would lead us to believe that early stage deal sizes are considerably smaller than their US counterparts but at the same time, the number of transactions is still way below where it should be (the 10% benchmark).

Source: Pitchbook.

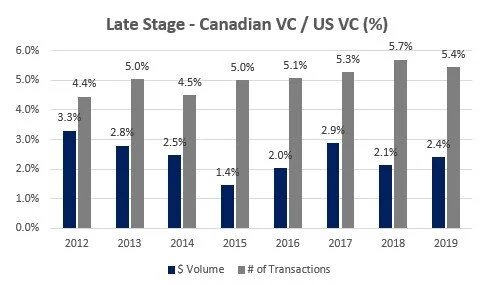

As expected, late stage investment is where we see an even more noticeable difference between Canada and the US, especially with regards to the dollars invested, which is running at just 2.4% - or 75% below where it should be! This is partly because of the explosion of mega-deals in the US which have really pushed up the dollar volume on the US side of things, but is still a very worrying trend for us.

Source: Pitchbook.

So while smaller deals are definitely to blame for the delta in the Canadian and US VC markets, it's not all the difference and shows us we still have a long way to go to catch the US.

About Sampford Advisors

Sampford Advisors is a boutique investment bank exclusively focused on mid-market mergers and acquisitions (M&A) for technology, media and telecom companies. We have offices in Toronto, Ottawa and the US and have done more mid-market tech M&A transactions than any other adviser.